October 10, 2021

In September 2021, China Insurance Security Fund Co., Ltd. (CISFC) released the Risk Assessment Report on China Insurance Industry in 2021 (the “Report”) in Beijing. This is the seventh consecutive year since 2015 that CISFC has compiled and published such an annual report. The Report provides a methodical look at the state and risks of the industry and serves as a valuable reference material for insurance regulators, institutions, and the industry as a whole. Its aim is to promote better risk management capabilities within the industry.

In 2020, instabilities and uncertainties in China have significantly increased due to the complex international situation, national reform challenges, and most importantly, the COVID-19 pandemic shock. Thanks to its economic resilience and advantageous institution, China registered better-than-expected growth and improving economic indicators. In the financial sector, incremental risks in critical areas were effectively controlled and existing risks gradually resolved; overall, risks have been controllable, without leading to systemic risk. At present, the pandemic keeps spreading in overseas regions, profound changes continue to shape internal and external environments, and the national tasks of reform, development, and maintaining stability remain formidable, all posing risks and challenges to China’s insurance industry.

The Report is organized into four parts: economic and financial environment, market overview, industry risk assessment, and expert observations. After reviewing the internal and external environments of China’s insurance industry in 2020, the report gives a comprehensive analysis of the state of the industry and, in particular, highlights the impact of the COVID-19 as well as the current operating and development risks. It mainly includes the followings:

I. Market overview

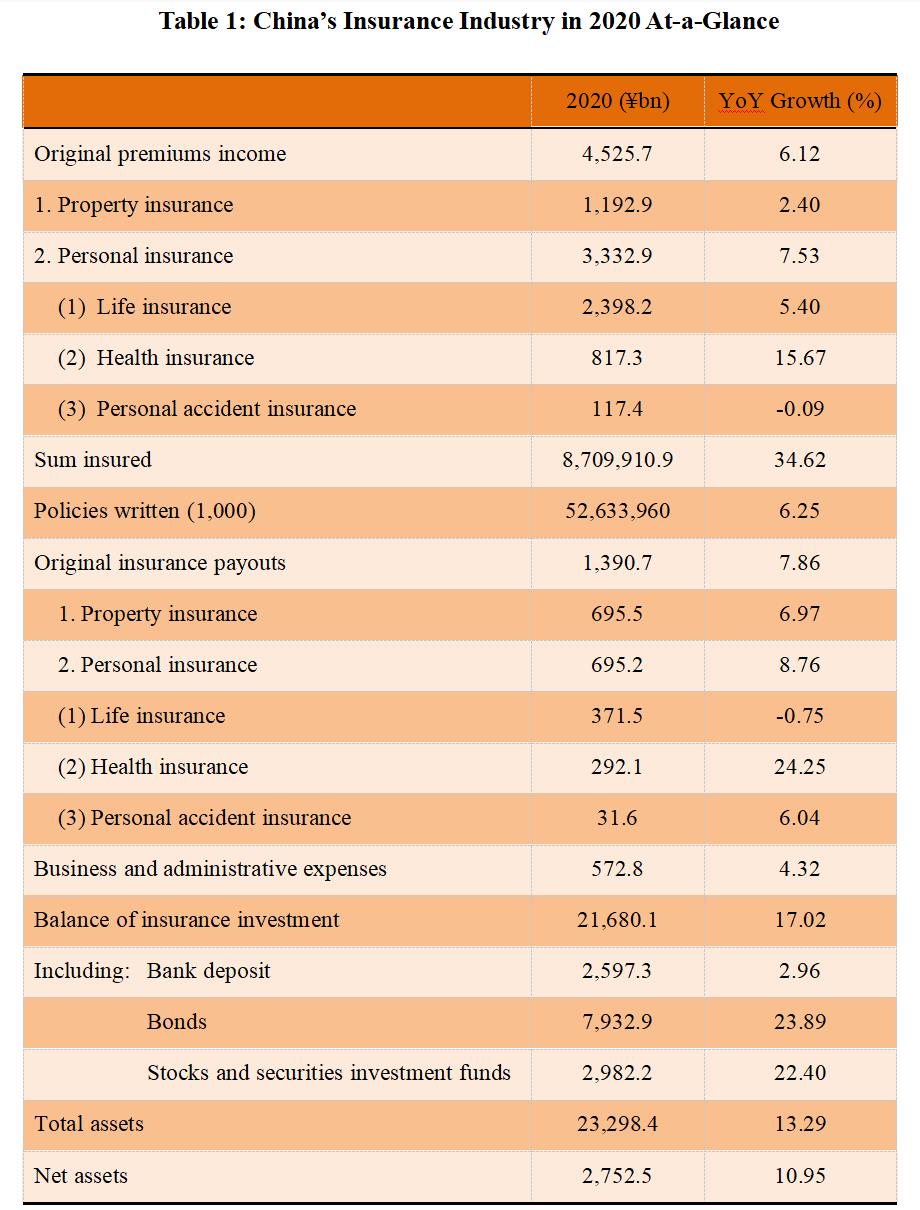

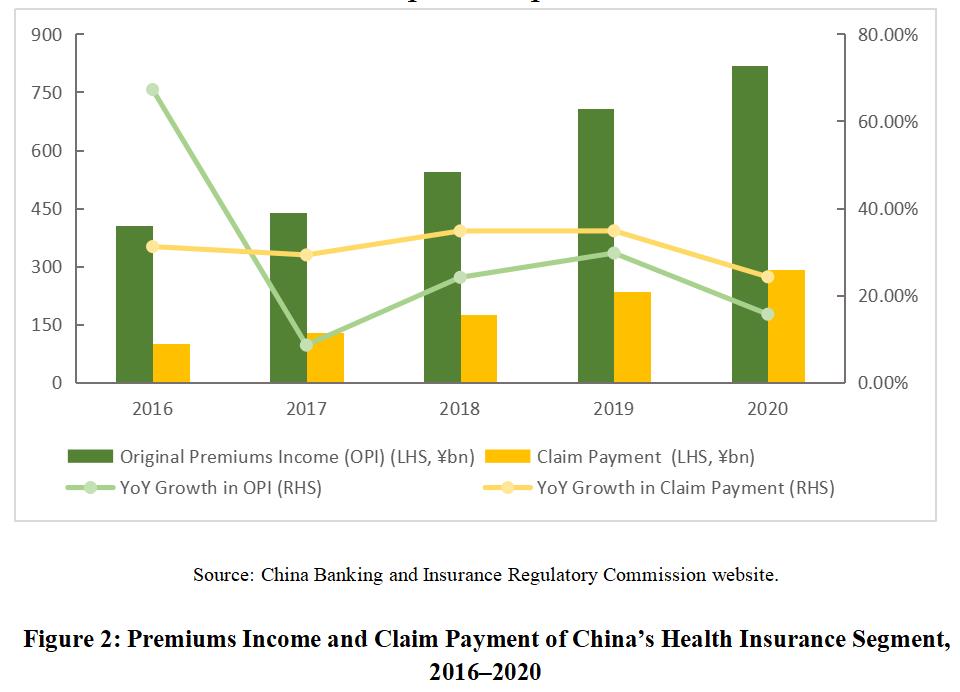

China’s insurance industry saw stable operation and premium recovery in 2020. Original premiums income grew 6.12 percent year-on-year (YoY) to RMB 4.53 trillion; with steadily growing asset size and relatively constant asset mix, total assets rose 13.29 percent from the beginning of the year to RMB 23.30 trillion, and net assets rose 10.95 percent to RMB 2.75 trillion. To power China’s economic and social development, the industry continued to boost support for critical areas and weak links, offering enhanced insurance protection: sum insured hit RMB 8,710 trillion, and the payouts reached RMB 1,390.7 billion. The industry as a whole maintained an adequate solvency level and continued to strengthen consumer protection.

II. Risk assessment

The COVID-19 outbreak in early 2020 hobbled China’s insurance companies in the first quarter. As the pandemic slowed down in the country, business and production resumed, and the government implemented a raft of special support policies, the insurance industry was able to fortify its protective screen against risks, especially those in critical areas, and maintain a momentum of development. At present, profound changes continue to shape internal and external environments, and the national tasks of reform, development, and maintaining stability remain formidable, all posing risks and challenges to China’s insurance industry.

The Report seeks to capture the evolving risks of the industry, systematically analyzes major risks in critical areas and links, keeps a watchful eye on conventional risks, and focuses on emerging exposures. It summarizes and analyzes major risks and challenges facing China’s insurance industry in the last year and even at present.

(1) Impact of the pandemic on the insurance industry

In terms of insurance risks, challenges to insurance distribution channels have intensified. First, the traditional salesperson-based channels have become less effective, slowing down the value accumulation of personal insurance companies. The pandemic severely hindered salespersons, and therefore the traditional sales models, from working effectively, which slowed down business growth, reduced sales staff’s income, and triggered a wave of resignations. At a deeper level, the decline in premium income on new, regular-premium policies, which have a comparatively higher value proposition, notably dragged down the value accumulation and affected the long-term profitability and risk resilience of personal insurance companies. Second, the bank and post-office channels regained popularity among the competing insurers, pushing up the cost. Amid the pandemic, some personal insurance companies redoubled their investment in these channels and achieved rapid growth in original premiums income. This has had a twofold effect. For one, greater competition has driven up the cost of these channels, and small- and medium-sized personal insurers, which don’t have the same bargaining power as their bigger competitors, found it hard to bear the climbing fee rates. In addition, this rapid growth requires much cash to sustain, as—in the short term at least—these channels mainly distribute single-premium policies which have a lower profit margin. Third, the internet channel remained underdeveloped and has yet to become an effective pathway for selling long-term insurance products. In response to the pandemic, insurance companies turned to the internet, which generated a personal insurance premium growth much higher than the written premium growth over the same period. However, the channel remained underdeveloped with a smaller share in the market, facing severe challenges such as inability to sell long-term insurance products and inadequate integration with offline business.

Source: Performance reports of listed insurance companies, Thirteen Actuaries Figure 1: Number of Salespersons and YoY Change of Four Listed Insurance Companies at End-2020

In terms of credit risks, the rise of leverage ratio and the changes to the guiding principles of monetary policies have made it more likely for external credit risks to spread to the insurance industry and exposed both the asset-side and the liability-side of the balance sheet to greater credit risks. Amid the pandemic, China’s targeted easing monetary policies and credit policies postponed credit defaults and led to a surge in macro leverage ratio. As the virus had been put under control, China shifted to a neutral and equilibrium-oriented monetary policy, allowing the previously suppressed default risks to resurface gradually, and increasing the overall credit risks. In 2020, both the default rate in the bond market and the proportion of state-owned enterprises among the defaulting issuers rose notably. Credit risk events of local state-owned enterprises were unexpectedly frequent. In this context, insurance funds that invested in fixed-income assets would have an increasing credit exposure; and factor in the mounting risk of local government debts, insurance companies holding bonds and non-standard products may be exposed to even higher levels of credit risk. When the industry allocated an ever-greater proportion of funds into non-standard assets, it also became exposed to the hidden default risks of some of those assets. There were insurers that were hit by the default events on collective trust plans and debt investment plans. Defaults on bonds, non-standard products, and other financial products also threatened to transmit external credit risks to the insurance industry through insurance investment, making it increasingly difficult for the industry to manage and control credit risks. In addition, insurance companies faced increased exposures by providing credit insurances for the credit enhancement of small- and medium-sized enterprises, which suffered from considerable operating pressure and poor cash flow and contributed to rising financing default rates.

As for market risks, changes in short-term interest rates increased the volatility of asset values, the downward trend in long-term interest rates would bring risks of loss from interest spread and reinvestment, and a more volatile equity market directly affected the investment return of insurance funds. Bond yield fluctuated wildly in 2020. Although most bonds would be held to maturity, a notable portion of insurance funds invested in available-for-sale and transactional bonds, the value of which were subject to short-term volatility. In the long run, the downward trend of the medium- and long-term interest rate pivot presented several challenges to insurance companies. First, the resulting increase in insurance reserve had a negative impact on solvency and current-period profit; second, the risk of reinvestment and loss heightened; and lastly, under the pressure of reinvestment, insurance companies tended to favor products that entail higher investment risks. In 2020, liquidity injection across the world pushed the global stock market to rise amid fluctuations. But due to increased external uncertainties, the global financial system was more fragile and capital markets at home and abroad underwent wider fluctuations. In a market with declining interest rates, insurance funds’ preference for stock was on the rise due to the relative scarcity of high-quality assets, and would therefore expose to larger market volatility.

(2) Intrinsic risks within the insurance industry

In terms of corporate governance risks, changes in equity structure, high share pledge ratio, and frequent changes or long-term vacancies of executives undermine the continuity and effectiveness of long-term corporate strategies and directly impact a company’s robustness and sustainability. In 2020, a total of 27 insurance companies underwent equity changes, with 5 of them by twice or more; in about a quarter of them shares were either pledged or frozen at the end of the year, of which 8 companies had a pledge or frozen ratio of more than 50 percent. In addition, a small number of companies have a highly complex equity structure—with prominent problems such as nominee and anonymous shareholding—and some still need to unwind the incompliant share transfers made long ago. Unstable equity structure directly leads to frequent changes and long-standing vacancies of executive positions. Among the companies with equity structure changes in 2020, 13 had replaced their chairmen or general managers, and 9 had a vacancy for those positions.

In terms of strategic risks, small- and medium-sized property insurers are being severely tested in making business transitions. In 2020 in the property insurance segment, a combination of declining net profit and rising combined ratio has resulted in across-the-board underwriting losses. Industry polarization is also becoming acute as small- and medium-sized property insurers are generally encountering operating challenges. Insurers’ annual disclosure reports show that in 2020, 78 small- and medium-sized property insurers had incurred a combined underwriting loss of RMB 9.878 billion in the top five lines of insurance; net operating cash inflow was RMB 623 million, but 36 companies had a net outflow. Furthermore, COVID-19 has prompted insurers to make the digital transition, becoming more reliant on online platforms for business development, underwriting, claims settlement, and post-sales service, and on technologies for addressing the complex risk management problems. But small- and medium-sized property insurers have a smaller basic dataset to work with and are less adept at using technologies, making this business transition process much more difficult in comparison.

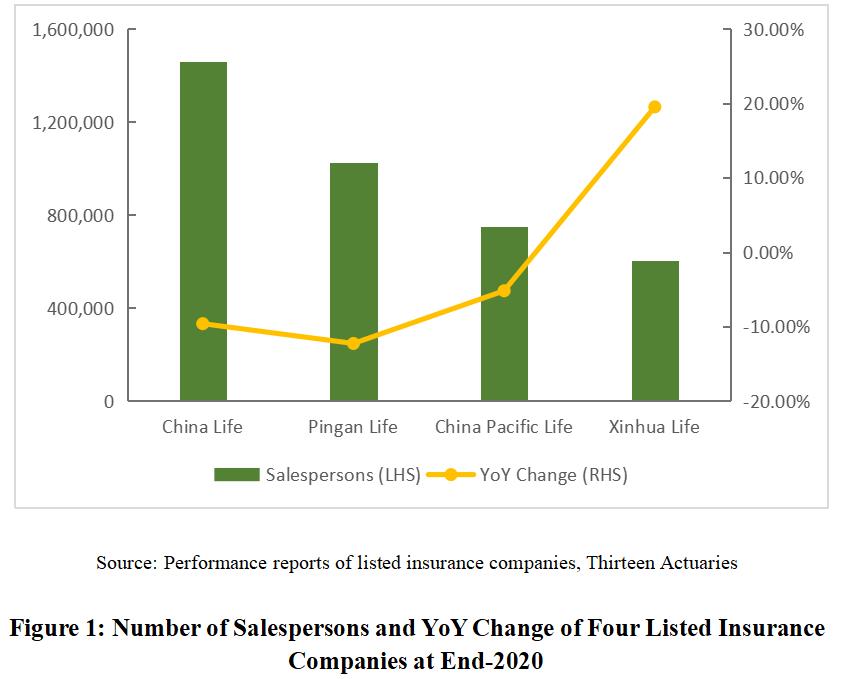

In terms of insurance risks, the health insurance segment is under great pressure. The segment has been growing rapidly at a compound annual rate of 27.67 percent between 2016 and 2020. At the same time, it is facing operating pressures from three directions. First, rising claims on critical illness policies. The incidence and detection rates of critical illnesses are both on the rise, making adverse selection a significant problem. Some insurance companies are also inadequately prepared to manage critical illness insurance, exacerbated by irrational competitive practices, weak pricing basis, and insufficient risk screening capabilities. Second, significant short-term losses on medical insurance. Medical costs have been surging in recent years and are consistently outpacing the growth of household income. Losses are made more likely due to a combination of bottlenecks in the sharing of medical data and lack of effective means to control medical treatment and decisions by insurers, lax underwriting process for some of the online-offered medical insurance policies, and withholding of medical history by consumers which leads to higher-than-expected medical expenses. Third, lack of expertise, empirical data, and ability to manage reputation risks in offering the novel inclusive insurance products. The operating risks confronting the health insurance segment can be easily masked by the strong growth momentum. Therefore, the sector should take these risks seriously and take precautionary measures early to avoid significant losses from over-ambitious business expansion plans.

In terms of operating risks, insurance companies still need to improve their operational compliance. In 2020 regulators continued to ramp up administrative penalties. CBIRC and its regional offices issued 2,084 administrative penalty decisions, sanctioning 1,226 insurance companies and 1,647 responsible individuals, gave a warning to 1,992 companies and individuals, and imposed a total fine of RMB 260 million. The most salient problems at the moment relate to auto insurance and personal insurance. The first is violations in the auto insurance segment. The top five reasons for administrative penalties against property insurers in 2020 are preparation of false materials, fictitious intermediary business to obtain fees, false financial or business data, provision of benefits to policy applicants beyond the insurance policies, and fictitious expenses, most of which are related to the auto insurance segment. The second problem concerns the development and management of personal insurance products. The regulatory authorities have released 3 circulars in 2020 on product-related issues at 62 personal insurance companies, including: (i) ambiguity or violation of legal requirements in the products’ terms and conditions; (ii) with respect to product design, short-term coverage for what should have been long-term product, reduced insurance protection, inconsistency between a product’s liability coverage and its purported functions, and excessively high pre-predetermined surrender rate; (iii) significant issues in rate making; (iv) non-conforming submission of product materials, submission of non-conforming information, and erroneous document references; and (v) deficiency in the sales rules for product combinations, non-compliant qualifications of the legally responsible individuals, and non-compliant provisioning of reserves.

III. Expert perspectives

Members of the Risk Assessment Expert Committee for Insurance Industry contributed eight observation articles to the Report, which reflect the results of their studies in each segment of the industry.

For the property insurance segment, experts believe that while the comprehensive reform of auto insurance has made business management and operation more challenging, it also brings opportunities, as refined management and professional operation will be critical to remaining competitive. In the sales domain, experts believe yesterday’s crude growth models have made horizontal competition in sales particularly fierce. Small- and medium-sized property insurers should instead look outward to find new growth drivers while building up corporate strength, so as to avoid the multitude of risks that come from intense horizontal competitions. Regarding underwriting property insurance for power companies, the experts predict that with China committing to carbon peaking and carbon neutrality goals, clean power supply, higher proportion of electricity use in the energy consumption structure, and the development of ultra-high voltage (UHV) grid will each create new risks. Consequently, insurers ought to conduct studies on the energy transition program, jointly maintain a reasonable set of criteria for underwriting new policies, and actively contribute to the ecosystem for ensuring China’s electric power security.

For the personal insurance segment, experts warn that liquidity risk should be closely monitored, as its mismanagement may cause even the highly solvent insurance companies to stumble. Experts believe the most significant factors affecting a personal insurer’s liquidity today are: (i) declining premiums income and rising surrender payments due to COVID-19; (ii) pressure from bulk payment of maturity benefit as short- and medium-term products mature at around the same time; (iii) ever-increasing holding of non-current assets as the low interest rate environment and intense product competition force companies to look for higher-yield investment options; and (iv) the high probability of a one-sided market in extreme market conditions—because personal insurance companies have similar investment strategies for some of the major asset classes—which would lead to market liquidity issues. The experts suggest personal insurance companies consider further improving the effectiveness of their liquidity risk management programs based on the existing frameworks. For the health insurance segment, experts think that while health insurance has a vast market potential in China and has been growing rapidly in recent years, products that provide long-term medical coverage, which are what’s needed to fundamentally address the public healthcare challenges and help alleviate the pressure on the country’s medical insurance and social security programs, are still confronted with issues including inadequate supply, lack of risk identification approaches, and elusiveness of profitability. The experts have identified the following issues in the health insurance market: competition being focused on the lower end products, lack of sophistication in pricing critical illness products, underdevelopment in the other types of products, and low utilization rate of health services. In response, experts suggest enhancing product innovation, leveraging big data technologies for intelligent pricing, and creating new business models to build a “health insurance + health management services” industry landscape.

Regarding asset-liability matching, experts believe that interest spread loss is one of the most significant risks at present. The cost of liabilities is standing firm and cannot be lowered in the short term. And in a low interest rate market, low interest yield has had a wide-ranging effect on the average rate of return on investment and underscores the risks of reinvesting assets. Furthermore, when interest rate drops, current financial and accounting standards require a corresponding reduction in the discount rate for reserves, which means future losses from interest rate spread will be fully reflected in the present financial year, which may result in current losses and insufficient solvency. Experts recommend insurers to strengthen coordination between assets and liabilities and reduce asset-liability mismatch. On the liability side, the recommendation is to optimize product maturities, reduce the duration gap, and make a persistent effort to lower the cost of liabilities and improve pricing management. On the asset side, it is suggested to increase the duration of assets, strengthen maturity structure matching, optimize the asset allocation structure, and improve return on investment and solvency management.

The experts also discussed building and running senior living communities. China’s aging population has highlighted the shortage of senior services. As insurance companies rush to build senior living communities, the experts warn that they should monitor the price and other risks arising from a long-term supply-demand imbalance in the senior living real estate market. The suggestion is that before undertaking such projects, insurance companies should make a strategic decision on the project model and timing, find its market positioning on the basis of its unique circumstances and competitive advantages and a full understanding and control of various risks, and harness technologies to make their pension insurance and long-term care insurance products more competitive. On the subject of insurance investment in environmental, social, and governance (ESG) projects, the experts think that the nature of insurance assets is highly aligned with the philosophies of ESG investment. Although ESG investment is new in China, domestic enterprises still have to make more complete disclosures, and ESG financial products are still fairly scarce, top-level designs are being improved and regulatory supporting policies are being introduced. The experts suggest that insurance companies should further enhance their ESG governance structure, and that regulatory authorities and industry self-regulatory organizations, by making policies and promoting industry exchange, can strengthen advocacy and guidance for insurance institutions to carry out ESG investment, and further encourage insurers to increase ESG investment and enhance information disclosure.