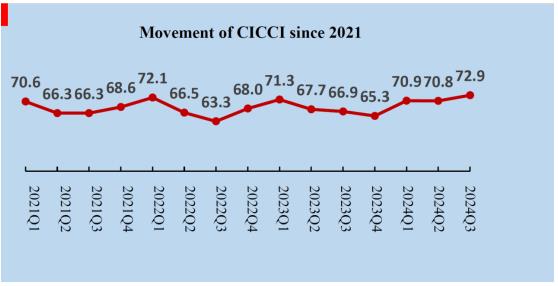

The China Insurance Consumer Confidence Index (CICCI) in Q3 2024 was 72.9, representing an increase of 2.1 from Q2 2024 and an increase of 6.0 over Q3 2023 and staying within the high confidence range (65, 85], reaching its highest value since Q1 2021. Since the beginning of this year, the insurance consumer confidence has continued an upward trend. In Q3, both quarter-on-quarter and year-on-year increase was seen in insurance consumers’ confidence in macro environment, confidence in insurance industry and confidence in individual spending.

Figure 1 Movement of CICCI since 2021

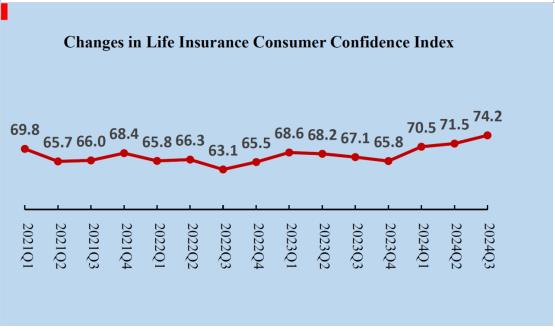

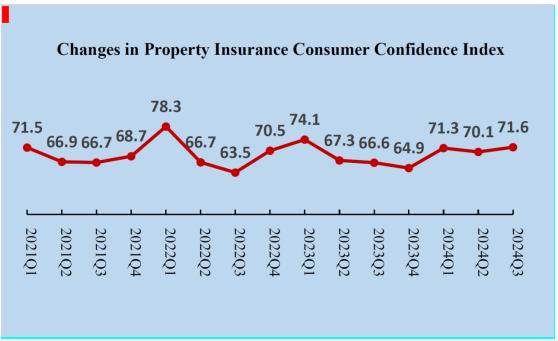

In terms of insurance types, the life insurance consumer confidence index and the property insurance consumer confidence index in Q3 were 74.2 and 71.6 respectively, with the former keeping within the high confidence range for eight consecutive quarters and the latter doing the same for three consecutive quarters.

Figure 2 Changes in Life Insurance Consumer Confidence Index

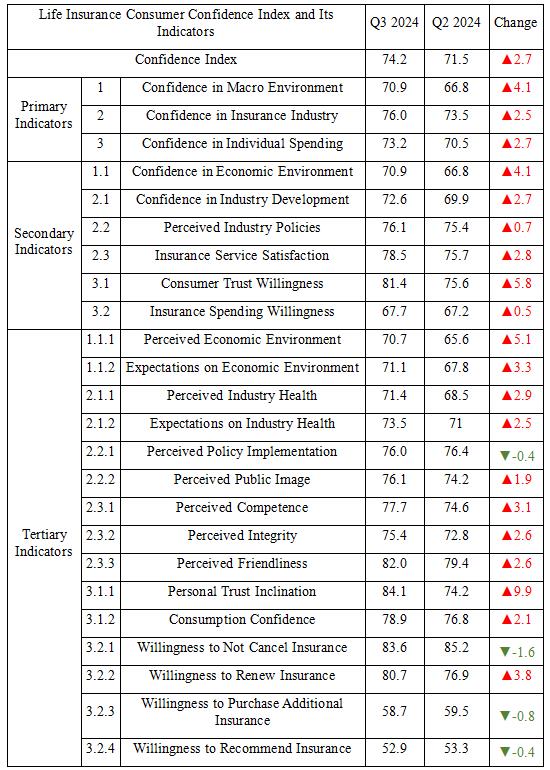

In Q3 2024, the life insurance consumer confidence index was 74.2, up 2.7 over Q2 2024 and up 7.1 from Q3 2023, staying within the high confidence range and reaching the highest value since Q1 2021. Its indicators showed the following trends:

On the quarter-on-quarter and year-on-year bases, three primary indicators and six secondary indicators all rose to some degree, all of which were within the high confidence range. Of all the primary indicators, the ones with noticeable quarter-on-quarter and year-on-year growth were all confidence in macro environment, and all the three primary indicators reached the highest value since Q1 2021. Of all the secondary indicators, the ones with noticeable quarter-on-quarter and year-on-year growth were consumer trust willingness, with insurance spending willingness, consumer service preference, and insurance service satisfaction reaching the highest value since Q1 2021.

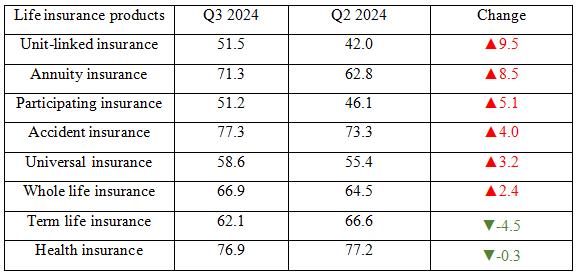

According to the survey on eight popular life insurance products in Q3, the index of willingness to purchase eight different insurance products, including accident, health, annuity, whole life, term life, universal insurance, unit-linked insurance plan and participating insurance, was greater than 50%, staying within the more positive range. The top three were as follows:

The index of willingness to purchase accident insurance was 77.3, up 4.0 from Q2 2024, with 57.1% of consumers believing that the possibility of purchasing accident insurance “will increase”, 40.5% believing that the possibility “will basically remain unchanged”, 2.5% believing that the possibility “will decrease”. In Q3, which was exactly the peak season for travel and tourism in summer, consumers’ demands for consumption of transportation, recreation and leisure were released in concentration, and thus their willingness to purchase accident insurance increased, representing an increase in consumers’ attention to travel-related accident insurance.

The index of willingness to purchase health insurance was 76.9, down 0.3 from Q2 2024, with 58.0% of consumers believing that the possibility of purchasing health insurance “will increase”, 37.9% believing that the possibility “will basically remain unchanged”, 4.1% believing that the possibility “will decrease”.

The index of willingness to purchase annuity insurance was 71.3, up 8.5 from Q2 2024, with 43.7% of consumers believing that the possibility of purchasing annuity insurance “will increase”, 55.2% believing that the possibility “will basically remain unchanged”, 1.1% believing that the possibility “will decrease”.

In this quarter, the top three insurance products enjoying the highest quarter-on-quarter rise in purchasing willingness index were unit-linked insurance plan, annuity insurance and participating insurance, which rose by 9.5, 8.5 and 5.1 quarter on quarter, respectively. In the first half of this year, PBOC cut LPR for twice, bank deposit rates continued to decline, residents’ demands for pension-related deposits were heightened, and the rise in willingness to purchase insurance products with more distinctive attributes as deposits, such as unit-linked insurance plan, was remarkable, which indicated that consumers’ attention to returns on investment of insurance products increased.

Since the beginning of this year, a favorable climate for insurance consumption has been created for high-quality development of the life insurance industry by the fact that consumer confidence in life insurance rose, and that consumer confidence in insurance spending willingness, consumer service preference, insurance service satisfaction and other indicators were all at high levels compared to the same historical period. It is recommended that market players pay attention to the trend of consumers’ purchasing willingness, optimize the supply of insurance products in a timely manner, and meet consumers’ needs in a targeted manner.

Figure 3 Changes in Property Insurance Consumer Confidence Index

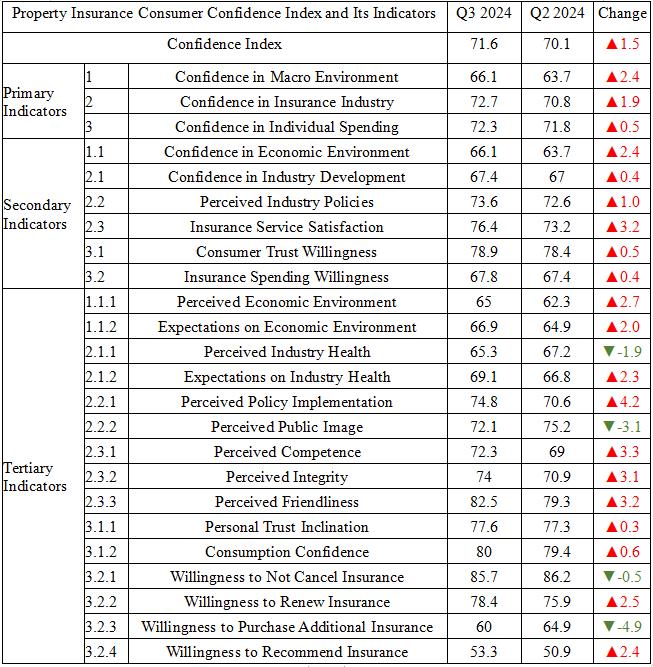

In Q3 2024, the property insurance consumer confidence index was 71.6, up 1.5 over Q2 2024 and up 5.0 from Q3 2023, staying within the high confidence range. Its indicators showed the following trends:

On a quarter-on-quarter basis, three primary indicators and six secondary indicators, which constitutes the index, all rose to some degree and stayed within the high confidence range. Of the primary indicators, confidence in macro environment rose noticeably and stayed within the high confidence range; a quarter-on-quarter growth was witnessed in confidence in individual spending for three consecutive quarters. Of the secondary indicators, insurance service satisfaction rose noticeably, and a quarter-on-quarter growth was seen in consumer trust willingness and insurance spending willingness for three consecutive quarters.

On a year-on-year basis, all the three primary indicators rose, with confidence in individual spending rising noticeably. Of the six secondary indicators, five rose and one fell, with confidence in perceived industry policies, insurance service satisfaction, consumer trust willingness, insurance spending willingness and confidence in economic environment rising, and confidence in industry development falling. Of the indicators, consumer trust willingness rose considerably.

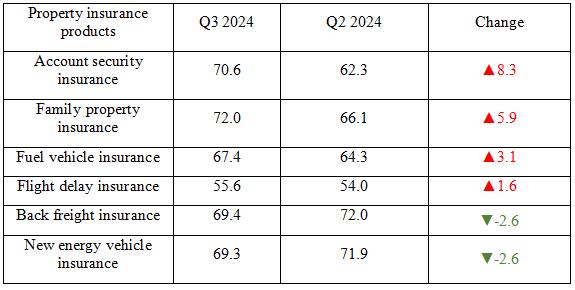

According to the survey on six popular property insurance products in Q3, the index of willingness to purchase six different insurance products, including family property, account security, back freight, new energy vehicle, fuel vehicle, and flight delay insurance was greater than 50%, staying within the more positive range. The top three were as follows:

The index of willingness to purchase family property insurance was 72.0, up 5.9 from Q2 2024, with 48.1% of consumers believing that the possibility of purchasing family property insurance “will increase”, 47.8% believing that the possibility “will basically remain unchanged”, 4.1% believing that the possibility “will decrease”.

The index of willingness to purchase account security insurance was 70.6, up 8.3 from Q2 2024, with 44.4% of consumers believing that the possibility of purchasing account security insurance “will increase”, 52.2% believing that the possibility “will basically remain unchanged”, 3.3% believing that the possibility “will decrease”.

The index of willingness to purchase back freight insurance was 69.4, down 2.6 from Q2 2024, with 44.6% of consumers believing that the possibility of purchasing back freight insurance “will increase”, 49.4% believing that the possibility “will basically remain unchanged”, 5.9% believing that the possibility “will decrease”.

In this quarter, the top three insurance products enjoying the highest quarter-on-quarter rise in purchasing willingness index were account security insurance, family property insurance and fuel vehicle insurance, which rose by 8.3, 5.9 and 3.1 quarter on quarter, respectively. This indicates that at present, consumers’ attention to their treasury accounts, family properties and private vehicles is increasing, and their risk control consciousness is improving.

Since the beginning of this year, the property insurance consumer confidence index has continued to enjoy a good momentum for steady growth, with an upward trend being sustained, and consumer trust willingness, insurance service satisfaction, insurance spending willingness and other indicators have all rose quarter after quarter, which indicated that the foundation for recovery of consumer confidence in the property insurance industry has been reinforced continuously. It is recommended that industry players pay close attention to the trend of consumers’ insurance consumption demand, and further optimize the supply of products, including family property insurance and account security insurance to satisfy consumers’ various demands for property risk protection.

Overall, the CICCI has recovered continuously since the beginning of this year, and the CICCI in Q3 reached the highest value since Q1 2021. Meanwhile, the indexes of willingness to purchase different insurance products in Q3 were all within the positive range, and the consumption demands for insurance are expected to be further released. It is recommended that market players take advantage of the continuously recovering consumer confidence, enrich their product supply, improve their security services, make their supply more adaptive to demands, continue to improve their consumer rights protection, and thereby better meet consumers’ demands for risk protection and wealth management in such aspects as health, pension, family property and fund security.

Annex 1: CICCI Scores for Q3 2024

Annex 2: Scores on the Index of Willingness to Purchase Insurance Products for Q3 2024

Notes on the Compilation of CICCI:

China Insurance Consumer Confidence Index (CICCI) survey covers 18 provinces, autonomous regions, and municipalities in Northeast, North, East, South, Central, Northwest, and Southwest China. These regions account for more than 90% of the national net premium written.

This round of survey uses a combination of two-phase stratified sampling, probability proportional to size (PPS) sampling, and random telephone sampling to collect 1,071 valid responses for inclusion in the index, comprising 531 from the life insurance segment and 540 from the property insurance segment. The online survey is completed with a big data-driven sampling frame and an AI-powered call system without human intervention. After a consumer answers the phone call and confirms his/her willingness to participate, the system will automatically send him/her a text message containing a link to the online survey form. This implementation ensures both consumer privacy and first-hand access to feedback.

CICCI gives a value from the [0, 100] range, 50 being the neutral result. A score higher than 50 indicates optimism, i.e., a larger proportion of insurance consumers is optimistic rather than pessimistic. The higher the score, the stronger the consumer confidence. Score ranges have the following meanings: (85, 100]: Very high confidence; (65, 85]: High confidence; (50, 65]: Average confidence; (35, 50]: Below-average confidence; (15, 35]: Low confidence; and (0, 15]: No confidence

The index of willingness to purchase insurance products refers to a kind of sentiment index, which is compiled through a simple method of diffusion index featuring “rise” proportion minus “drop” proportion, i.e. the percentage of positive response plus a half of the percentage of unchanged response. Calculation formula: Purchasing willingness = Percentage of the option “increase” * 1 + percentage of the option “unchanged” * 0.5 The value range is [0,100], 50 being the neutral result. A value greater than 50 represents that the purchasing willingness is within the more positive range, while one less than 50 represents that the purchasing willingness is within the more negative range.